Using Delta Zones

Order flow trading is a favorite trading strategy among some of the largest traders and prop shops in the market. Its also a favorite of some of the largest trading names on twitter like Tick Toc Tic. While this is not a magical trading black box that will turn you into a profitable trader overnight, it will teach you how to think like some of the best traders in the industry.

What is Order flow?

Simply put, order flow is just just the price fluctuations inside the market. “But how do you trade that” you might be asking, well you need a platform that can help you see it. The old school way is just to watch the level 2 and the Time and Sales; but with footprint charts, volume by price, and delta at price information available to retail traders through Sierra Chart and a few other platform it is easier then ever to implement an order flow strategy into your trading. If you want to read more on what a Footprint Chart, Delta at Price, and Volume by Price are you can click here.

All of these tools will allow you to pull back the curtain and see what is actually moving the future markets your watching.

Is this push up on light volume? – The Volume by price will show you this as will a properly setup DOM.

Are there more buyers then sellers on this push? – The delta at price will show you this as will buyers and sellers on the tape (also will the tool we built linked here).

How is the structure of the move? – The footprint will show you this.

These are all examples of order flow and once you learn to read them you will be able to more adeptly trade in your respective markets.

How to Trade the Order Flow

Trading order flow is actually quite simple (I said simple not easy), you will look at things like the following:

- Are there big buy or sell orders on the tape?(below)

- Is there any follow through by buyers and sellers? Are the continuing to buy and sell?(Last size column on the right)

- How large or small are the repeat buyers and sellers? Are the stepping volume up?(also last size column on the right)

- Was it a stop run or is this a legitimate push through a level?

- How does the structure look?(Completed Auction below)

Tools we use to trade Order Flow

As was stated above there are a few tools we use to trade order flow. There is an entire other post strictly on The Tools of Order flow if you need a refreshers or this is your first go round with Sierra Chart.

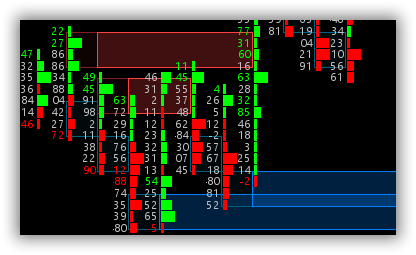

The First tool we use is the Footprint chart, and example is to the left of a footprint chart for the ES. The footprint shows us live bid and ask trades and allows us to see where volume is trading. You will be able to see inside the candlestick chart to see where buyers and sellers really battled (thick volume) and where one side petered out (thin volume/Imbalances).

The next tool we use is the Delta Footprint. Similar to the footprint above it displays trade information from inside the candlestick, but that’s where the similarities end. The Delta footprint shows the net buyers minus the net sellers so that you can see where more people were buying or more people were selling. Matched with the DOM its an incredible way to see areas of absorption and potential places for a reversal.

The screenshot to the right shows a basic Delta Footprint for NQ as long with our Delta Zones tool to show that buyers really took control after there were a bunch of sellers offside at the bottom of the move(the blue overlapping boxes). Once they made it through the red zones it was really game on for buyers. This is a perfect example of letting order flow give you a setup.

The Volume by Price is the next tool that we use a lot in order flow trading. This tool is two fold, it will show you structural locations to look for trades as well as live volume to see if a move has volume behind it. Volume is the life blood of the market so anything real has a lot of Volume chasing it.

Finally there is the DOM. I would argue that there is no singular more useful tool when it comes to trading order flow. And the best of the best with that is Sierra Chart. Some traders argue Jigsaw, and while I have tried them both I still tend toward Sierra Chart. The standard DOM I trade with can be seen on the Tools post. But for a refresher:

1. It has the Buy and Sell Columns

2. Pulling and Stacking columns to see when Buys are really stacking on bids and when Sellers are really laying on offers

3. Recent Volume to show what side is hitting aggressively

4. Market Orders to show where the size is waiting to get filled(also called liquidity)

The DOM is completely personal though, I know plenty of great traders who only trade with a Buy and Sell column and then the Tape to show the completed orders. It is completely personal.

Putting it All together

Now lets run through a sample trade taken based off of order flow. There will be another post soon that shows few more trading setups, so this is just the most basic.

First we look for a structure that we are comfortable taking a trade off of. My Mentor in The Pit uses Low Volume nodes so to keep with what he taught me you look at the Volume by Price and look for a low volume node. In our case we will take an example from a few days ago on the ES. We look at the volume fade off going into 4016.50.

With our Structure achieved we will wait for a confirmation on either a Delta Zone or a footprint signal to short it.

As you can see we got a few different triggers to this trade. First we had a Delta Zone appear right under our 4016.50 level. Then we go several candles that gave completed auctions and volume fade off. All of then would have been good for several points. The best would have been the last one though (not in the screenshot). Go got a completed auction, volume taper, and a VTG Sell Zone and you could have rode it for almost 50 ES points if you held. There is no way I would have but everyone’s style is different.

Wrapping it up

There you have it. The very basics of order flow trading. There are a few things I would like to add to this though. First is Money Management. You can have the best system on the planet, but if you can’t manage your trade to and take the money home it really doesn’t matter. Hone your management skills. The Second thing is if you are at all interested in this kind of trading I strongly Recommend the Pit. They have a whole write up here.