Order Flow trading has several tools that are required if you are going to be successful. They are not necessarily complicated, but they do all have a learning curve. Below is a basic overview of each of the Tools of Order Flow.

The Volume By Price

The Volume by Price is the foundation of all Order Flow trading. It allows you to identify areas that market participants had a great interest trading and had no interest trading. This interest in gauged by using volume nodes. An area of high volume (High Volume Node) shows that a lot of transactions and lots were traded here. These are thick areas of trading and often result in chop and churn making putting on trades difficult.

By contrast an area that has little interest is a Low Volume Node. This is some Place that there was not a lot of size transacted and can result in a great locations to take a trade. Areas of low volume have one of two typical reactions: They run through the area in a quick move or the reject off of it confirming that there is still no interest trading in the zone. The second is what we are after. We want the rejection to play off of. We can combine these areas of low volume with some other tools to create a great trade plan with low risk.

Delta at Price/Delta Zones

The next tool in our box is the delta at price and by extension our VTG Delta Zones tool that measures areas of potential reversal. Delta at price looks very similar to the picture above of the Volume at Price. The difference is that the peaks and valleys will be much smaller due to the fact that its the net buyers minus sellers. And while this is a very valuable way to find areas of reversal I prefer the Delta at price footprint.

The footprint will be discussed in greater detail below, but it can be used to show delta at each price, volume at each price and just the raw trades at each price. The delta at price footprint shows blocks of buyers and sellers to see who is the dominant participant at each level. This is helpful to see if its a functioning auction process or if there are one group of buyers and sellers that are offsides. These offsides participants are the fuel needed for a reversal and the exact thing our Delta Zones are deigned to show.

The blue rectangle aligns with our Delta tool to find the bottom of the move. These large groups of only red blocks show that there were a bunch of sellers who thought the move would continue down. When the price stopped they eventually realized they sold the low and that fueled the move higher. The opposite is true for the red rectangle at the top of the chart. While our tool did not signal it the same concept is valid. There are a bunch of green blocks at the tops of all the candles and it ended up being a great area of reversal.

The Footprint

The footprint is a general term of any chart type that shows the structure of the transactions inside a candle . The above is a version of a footprint chart that shows delta. There is also a raw footprint chart that shows the volume on the bid and the ask at each price. This is an incredibly useful tool for watching the auction process. You can see how thick the transaction volume is at each price, you can see when on participant comes and rips through the standing offers, and you can see when volume fades off and one group of participants is offsides. It really is a one stop shop in terms of execution for order flow trading.

The above is an excellent example of a regular footprint. You can see the volume fade off at the top and bottom of the candles. You can see where price was ripped through the book and you can see imbalances and trade signals against our zone. This shows the strength of the auction process and whether or not the move is backed by volume. It is just an outstanding tool for order flow.

The DOM and the Tape

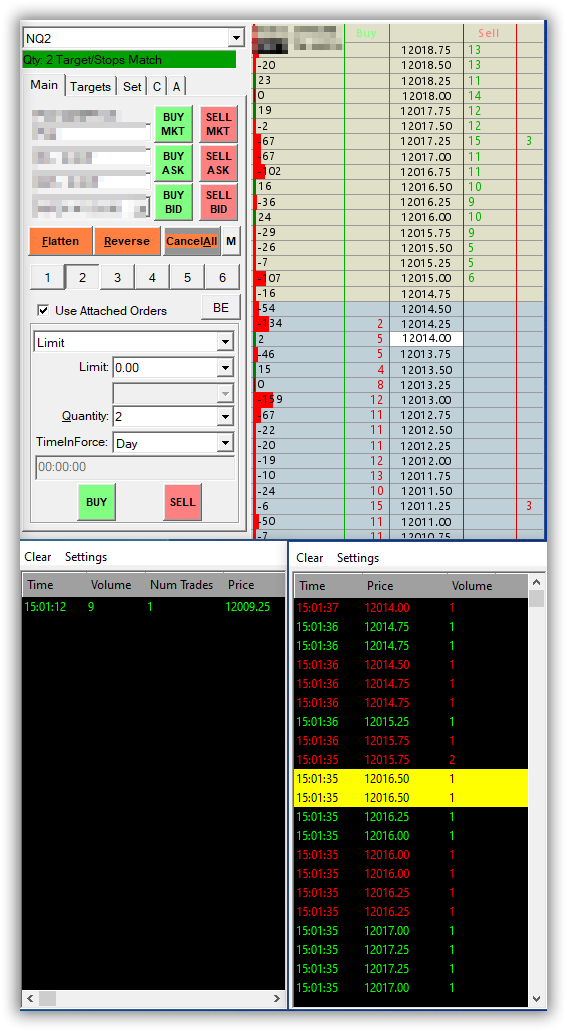

Finally there is the most versatile tool in the box, the DOM and the Tape. These two will show you all of the information you need to know. Everyone’s DOM will reflect their individual trading style. My person DOM has the regular buy and sell columns, it has the pulling and stacking, its got recent volume, and it has Market By order. The buy and sell columns are pretty self explanatory, they show the bids and offers up the ladder. The pulling and stacking shows what bids and offers are being added or pulled from the ladder. This shows which side has strength and which side is retreating. The Recent Volume columns show the last trades off the bid and the offer and help to show aggression. This helps to confirm if the move is being supported by big buying/selling for if its being pushed around by little players. Finally there is the market by order which shows where larger orders are “hiding” on the book to show liquidity. The other side of the DOM is the tape.

The Tape is the completed transaction the happens. When prices are continuing lower you will see size selling and smaller size buying. The reverse is true for buying. This is where the tape comes into play, it allows you to see what is actually getting filled off the DOM. It is great to see bids chasing the price up, but if none of them are willing to actually get filled then it doesn’t matter. The tape will show you where the real transactions are going, higher or lower. It is not uncommon for traders to have multiple tapes either. I know I trade with a regular tape and a large lot tape for trades over a certain size. This will help to show where the largest players are positioning.

The image on the right is my NQ setup, its got my DOM, my Trade screen, my large Lot Tape and my regular tape with alerts.

Final Thoughts

These are the main Tools of Order Flow. These tools will help to advance your trading and mastery of these tools will help to catapult you into the upper echelons of trading.